Changes coming to IDR: A law was passed on July 4, 2025, that makes several changes to borrowers’ repayment options. The new Repayment Assistance Plan (RAP) will replace most existing IDR plans (including SAVE, PAYE, and ICR) by July 1, 2028. The IBR plan will also be available for existing borrowers who don’t take out or consolidate any loans after July 1, 2026. Additionally, the law ends most Parent PLUS borrowers’ access to any IDR plan unless they consolidate before July 1, 2026, and are enrolled in an IDR plan before July 1, 2028.

Current borrowers should understand how these changes may impact them and pay attention to upcoming deadlines to avoid missing out on current benefits.

Looking for an affordable student loan repayment plan? You may be eligible for an income-driven repayment plan, also known as an IDR plan. You can sign up for an IDR plan online or by calling your loan servicer and requesting a paper application.

If you sign up for an IDR plan, you may qualify for payments as low as $0 per month based on your income. Plus, you can make progress toward having your loans forgiven (canceled) and being student debt-free on an IDR plan, even if your payment is $0 per month.

There are several different IDR plans, but all of them work in the same way: Your monthly payment amount is set each year based on your current income and family size, and can go up if you make more money or down if you make less or your family grows. After a certain number of years of making payments, any loan balance you have left is forgiven (canceled). And thanks to the Department of Education’s 2024 one-time payment count adjustment, more borrowers should have more credit toward IDR loan cancellation. Beginning in 2026, any student loan debt forgiven through the IDR program may be treated as taxable income. See our page on IDR loan forgiveness for more information.

Need more help choosing an IDR plan?

You can use the Department of Education’s free Loan Simulator Tool to compare plans and decide which is right for you. The Tool is just an estimate and may not always be accurate. It is best to use the Tool while logged into your studentaid.gov account.

My IDR payment seems too high. My loan servicer made a mistake. What can I do?

If you disagree with how your loan servicer calculated your IDR payment after you applied, contact your servicer. It’s possible they made a mistake. You may also be able to switch plans to get a lower monthly payment amount if there wasn’t a mistake. If you still think the payment amount is wrong, you can file a complaint with the Federal Student Aid Ombudsman.

IBR

- Income-Based Repayment (IBR)

- Payments capped at 10-15% of income over 150% of the federal poverty level

- Most Direct and FFEL Loans taken out before July 1, 2026, are eligible (except Parent PLUS Loans unless they are first consolidated into a Consolidation Loan before July 1, 2026, and then enrolled in an IDR plan before July 1, 2028)

- IBR will not be available to borrowers who have any loans issued or consolidated on or after July 1, 2026

- Cancellation after 20-25 years

- Qualifies for PSLF

PAYE

- Pay As You Earn (PAYE)

- Payments capped at 10% of income over 150% of the federal poverty level

- Only Direct Loans taken out by certain borrowers between 2007 and 2026 are eligible, and Parent PLUS loans and Consolidation loans that repaid Parent PLUS Loans are ineligible

- PAYE will not be available to borrowers who have any loans issued or consolidated on or after July 1, 2026

- This plan will be eliminated for all borrowers by July 1, 2028

- Cancellation after 20 years

- Qualifies for PSLF

ICR

- Income-Contingent Repayment (ICR)

- Payments capped at 20% of income over 100% of the federal poverty level

- Most Direct Loans taken out before July 1, 2026, are eligible (Parent PLUS Loans are only eligible if they are consolidated into a Direct Consolidation Loan before July 1, 2026, and enrolled in ICR before July 1, 2028)

- This plan will be eliminated by July 1, 2028

- Cancellation after 25 years

- Qualifies for PSLF

SAVE

- Saving on a Valuable Education (SAVE)

- As of fall 2025, the SAVE plan is currently on hold due to temporary court orders. Borrowers cannot enroll in the SAVE plan now. Borrowers who are already enrolled in SAVE have been placed into an automatic forbearance; this means they cannot make payments, earn credit towards loan forgiveness, or get loan forgiveness in the plan. Additionally, the SAVE plan will be eliminated for all borrowers by July 1, 2028, if not sooner. Read our blog post for more information on what’s happening with the SAVE plan.

- Payments are capped between 5% and 10% of your income, and interest not covered by your payment is waived.

- Cancellation after 10-25 years of payment

IBR: Income-Based Repayment

Which loans are eligible?

All Direct and FFEL Loans taken out for your own education before July 1, 2026, are eligible for IBR, unless you take out any new loans or consolidate loans on or after July 1, 2026.

Parent PLUS loans, taken out for your child’s education, are not eligible for IBR. However, if you consolidate Parent PLUS loans into a Consolidation Loan before July 1, 2026, and enroll them in any IDR plan before July 1, 2028, then you can enroll in IBR.

How much are payments?

Your monthly payment is based on your income and family size and depends on when you borrowed:

- Payments are 10 percent of your monthly discretionary income (the difference between your income and 150% of the poverty guideline) if you were a new student loan borrower on or after July 1, 2014.

- If you borrowed before then, payments are generally 15 percent of your monthly discretionary income.

In IBR, just like in PAYE, payments will never be higher than what you would pay in a fixed 10-year standard repayment plan.

You must recertify (update) your income and family size each year, even if they haven’t changed. If you’re married, you and your spouse’s income and student loan debt will be considered to determine your payment if you file your taxes jointly. If you file your taxes separately, only your information is used to determine your payment. nt.

When will my loans be canceled under an IBR plan?

If you continue to make payments under IBR, anIf you continue to make payments under IBR, any remaining balance on your loans should be canceled after:

- 20 years of payments if you were a new student loan borrower on or after July 1, 2014, or

- 25 years if you borrowed before July 1, 2014.

Depending on your income and debt, you may pay off your loans before you reach 20 to 25 years of payments.

Is this plan right for me?

IBR is the only one of the current income-driven repayment plans that will continue after July 1, 2028, though the new RAP plan will be added as an additional option. IBR offers payments that may be the most affordable for some borrowers, with payments as low as $0 for borrowers with income below 150% of the federal poverty level, and protection against payments ever exceeding what the borrower would owe in a 10-year fixed payment plan. It also offers forgiveness of any remaining balance after 20-25 years.

People who borrowed between 2007 and 2014 may be eligible for lower payments in PAYE than in IBR, but PAYE will be eliminated by July 1, 2028. IBR is also the only income-driven repayment plan available to borrowers with FFEL loans. And after July 1, 2028, it will be the only income-driven repayment plan available to borrowers who took out Parent PLUS loans, though even then will only be available to those who jumped through several hoops: parents must consolidate their Parent PLUS loans before July 1, 2026, and enroll in IDR before July 1, 2028, to be eligible for IBR.

PAYE: Pay As You Earn

PAYE is being eliminated: The PAYE plan will end by July 1, 2028. Any borrowers enrolled in this plan at that time will be transitioned to another plan. Borrowers who are currently on the PAYE plan can switch to a new plan now or wait for the plan to end. Follow NCLC and studentaid.gov for more updates.

Which loans are eligible?

The following types of loans are eligible for PAYE if the borrower meets other eligibility requirements:

- Direct Subsidized and Unsubsidized Loans,

- Direct Grad PLUS Loans, and

- Direct Consolidation Loans that do not include Parent Plus loans.

In addition, you are only eligible for PAYE if your payment in PAYE would be less than your payment in a Standard plan, and if you borrowed your loans in specific time windows. You must have:

- received a Direct Loan on or after October 1, 2011; and

- had no outstanding Direct or FFEL loan balance when you received your first federal loan on or after Oct. 1, 2007; and

- not received any federal student loans or consolidated any federal student loans after July 1, 2026.

How much are payments?

Your monthly payment is based on your income and family size. Payments are 10 percent of your monthly discretionary income (the difference between your income and 150% of the poverty guideline), but will never be higher than what you would pay under the 10-year Standard repayment plan.

You must recertify (update) your income and family size each year, even if they haven’t changed. If you’re married, you and your spouse’s income and student loan debt will be considered to determine your payment only if you file your taxes jointly. If you file your taxes separately, only your information is used to determine your payment.

When will my loans be canceled under a PAYE plan?

If you continue to make payments under PAYE, any remaining balance on your loans should be canceled after 20 years of payments. However, because the PAYE plan is being eliminated by July 1, 2028, and borrowers are only eligible for PAYE if they first borrowed after October 1, 2007, very few borrowers in PAYE will have reached 20 years of qualifying payments before the PAYE plan is eliminated. However, borrowers switching from PAYE to IBR or RAP will keep the credit toward forgiveness they have earned in PAYE, and it will count toward the 20-25 year forgiveness period in IBR and the 30-year forgiveness period in RAP. You may pay off your loans before 20 years, depending on your income and debt.

ICR: Income-Contingent Repayment

ICR is being eliminated: The ICR plan will end by July 1, 2028. Any borrowers enrolled in this plan at that time will be transitioned to another plan. Borrowers who are currently on the ICR plan can switch to a new plan now or wait for the plan to end. Follow NCLC and studentaid.gov for more updates.

Which loans are eligible?

- Direct Subsidized and Unsubsidized Loans,

- Direct Grad PLUS Loans, and

- Direct Consolidation Loans, including those that repaid a Parent PLUS loan.

FFEL loans and Parent PLUS loans that have not been consolidated are not eligible for ICR.

Borrowers will not be eligible for ICR if they take out a loan or consolidate their loans after July 1, 2026.

ICR was the only IDR plan available to borrowers with Parent PLUS loans – provided that they first consolidated their loans into a Direct Consolidation Loan. While ICR is being eliminated, Parent PLUS borrowers who act fast can enroll in IBR, which often offers more affordable payments than ICR. To enroll in IBR, Parent PLUS borrowers must first consolidate their loans before July 1, 2026, and then must enroll in an IDR plan (generally ICR) before July 1, 2028. They can then switch to the IBR plan, or will be transferred to the IBR plan on July 1, 2028. For more help, see our page on consolidating loans.

How much are payments?

Your monthly payment is based on your income and family size. Payments are capped at 20 percent of your monthly discretionary income (defined for ICR as income over 100% of the poverty guideline). However, it may be lower based on a complicated alternative formula.

You must recertify (update) your income and family size each year, even if they haven’t changed. If you’re married, you and your spouse’s income and student loan debt will be considered to determine your payment only if you file your taxes jointly. If you file your taxes separately, only your information is used to determine your payment.

When will my loans be canceled under an ICR plan?

If you continue to make payments under ICR, any remaining balance on your loans should be canceled after 25 years of payments. You may pay off your loans before 25 years, depending on your income and debt.

Is this plan right for me?

ICR is generally the most expensive IDR plan, but for a long time, it was the only plan available for borrowers with Parent PLUS loans that were consolidated into Direct Consolidation Loans. ICR will be eliminated for all borrowers by July 1, 2028. Use the loan simulator to estimate your payments in different plans.

SAVE: Saving on a Valuable Education

SAVE is being eliminated: The SAVE plan will end by July 1, 2028. Any borrowers enrolled in this plan at that time will be transitioned to another plan. Additionally, court orders mean that the SAVE plan is currently blocked and borrowers cannot sign up for the plan, and those already in SAVE cannot benefit from the plan. Borrowers who are currently on the SAVE plan should consider switching to a new plan now if they want to continue to earn credit toward IDR or PSLF cancellation. Follow NCLC and studentaid.gov for more updates.

The SAVE plan replaced the REPAYE plan. Borrowers who were already enrolled in the REPAYE plan were automatically transferred to the SAVE plan. Some of the SAVE plan benefits were implemented early in September 2023, but many benefits that were supposed to go into effect by July 1, 2024, were put on hold due to court cases challenging the plan.

Unfortunately, due to these court cases, borrowers can no longer sign up for this plan as of spring 2025. This plan will also be eliminated by July 1, 2028, due to a new law changing the student loan system. Borrowers who were already on the SAVE plan before the court injunctions went into effect should have been placed on a forbearance. The forbearance means that payments are not due, but interest began accruing again on these loans on August 1, 2025..Time spent on this forbearance does not count toward PSLF and IDR cancellation. If you are on the SAVE plan and want to continue earning credit toward PSLF or IDR cancellation, consider switching to another IDR plan, as the SAVE plan will end by July 1, 2028.

While the SAVE plan is blocked, we have described its various benefits below.

Which loans were eligible for the SAVE plan?

- Direct Subsidized and Unsubsidized Loans,

- Direct Grad PLUS Loans, and

- Direct Consolidation Loans that do not include Parent Plus loans.

Parent Plus Loans or Direct Consolidation Loans that paid off Parent Plus loans were not eligible for SAVE.

How much were payments supposed to be under SAVE?

Under SAVE, your monthly payment was based on your income and family size. If you made less than 225 percent of the Federal Poverty Line for your family size, you would have had a $0 monthly payment. Until July 1, 2024, if you made more than 225 percent of the federal poverty line, your monthly payments were 10 percent of the portion of your income above that amount.

After July 1, 2024, if you made more than 225 percent of the federal poverty line and only borrowed loans for your undergraduate education, your monthly payment should have been 5% of any income above 225 percent of the federal poverty line.

If you only borrowed loans for graduate school, your monthly payment was supposed to be 10% of your income above 225% of the federal poverty line. If you borrowed for both graduate and undergraduate schools, your monthly payment was supposed to be a weighted average of your loans, and it would have been between 5% and 10% of your monthly income above 225% of the federal poverty line.

You must recertify (update) your income and family size each year, even if they haven’t changed. If you’re married, you and your spouse’s income and student loan debt will not be considered together to determine your payment if you file your taxes separately (with limited exceptions).

Your loan balance was not supposed to increase while enrolled in the SAVE plan.

One of the biggest benefits of the SAVE Plan is that the Department of Education would stop charging you interest not covered by your SAVE plan payment. This means that, unlike other IDR plans, you will not see your total loan balance increase while making payments in the plan.

When were loans supposed to be canceled under the SAVE plan?

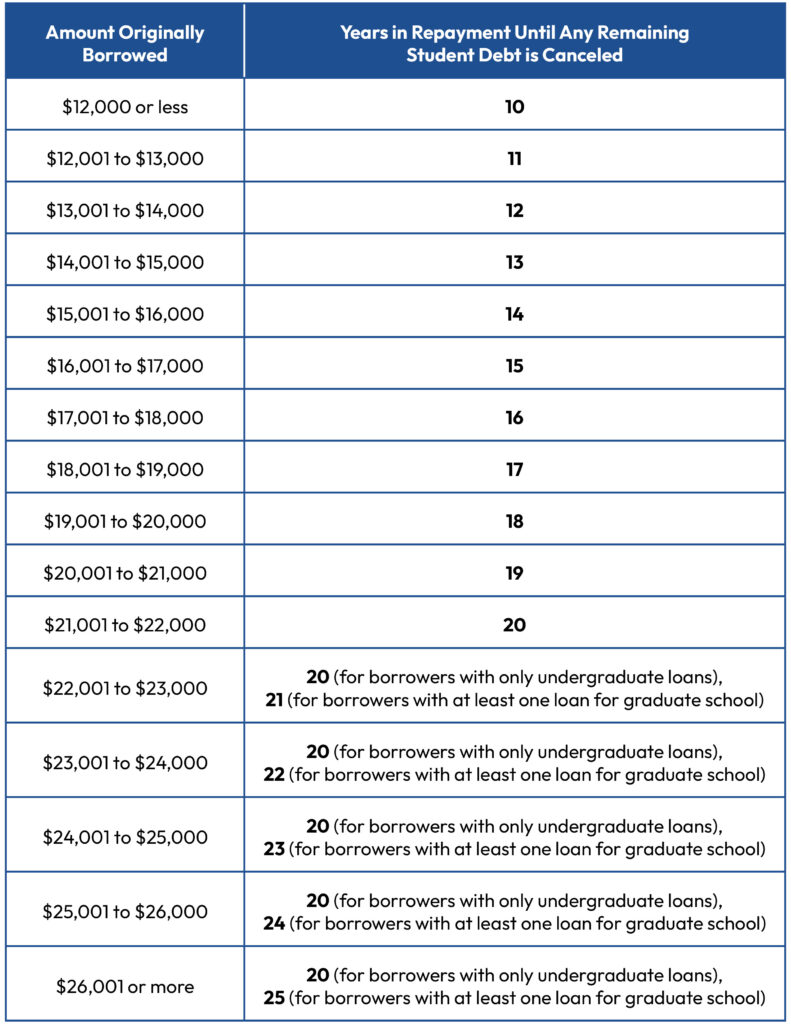

If you continue to make payments under SAVE, any remaining balance on your loans was supposed to be canceled after:

- 10 years of payments if you borrowed $12,000 or less in principal on your loans;

- Less than 20 years of payments if you borrowed less than $21,000 and only borrowed loans for undergraduate education;

- 20 years of payments if all of the loans you’re repaying in the plan were for undergraduate education, and you borrowed more than $21,000;

- Less than 25 years of payments if you borrowed any loans for graduate school, and you borrowed less than $26,000 in principal;

- 25 years of payments if any of the loans you’re repaying in the plan were for graduate school, and you borrowed more than $26,000 in principal.

See the chart below and our blog post on this issue for more information on when borrowers were supposed to be eligible for cancellation under the SAVE plan. Again, because of court cases challenging the SAVE plan and the new law that will eliminate this plan, new cancellations under this program have been blocked. lan. Again, because of court cases challenging the SAVE plan, new cancellations under this program have been blocked.