Important Note: On June 24, 2024, two court decisions temporarily blocked parts of the SAVE Plan from taking effect. These decisions may change borrowers’ rights and access to certain benefits, including repayment plans. We will update this website with more details on how this will impact borrowers soon. Visit here for more information.

Under an income-driven repayment (IDR) plan, you may be eligible to have any remaining balance on your student loans automatically canceled or forgiven after 20 to 25 years, and for some borrowers, loans will be canceled in as little as 10 years! This depends on the plan you’re enrolled in and the amount you originally borrowed. Cancellation under the IDR program depends on the plan you’re enrolled in, the loans you have, the amount you originally borrowed, and whether you took out loans for undergraduate or graduate education. If you qualify for PSLF, you may also be eligible to have your loans forgiven in 10 years.

One-time IDR account adjustment will help millions of borrowers!

Historically, only a handful of people ever received loan cancellation and forgiveness through the IDR loan forgiveness program, even though millions of people were potentially eligible. This is because loan servicers didn’t keep track of student loan payments and records and steered borrowers into other repayment plans, deferments, and forbearances instead of IDR plans.

Because of these problems, the Department of Education announced a new one-time account adjustment program to help give borrowers more credit toward forgiveness through IDR or PSLF. The one-time account adjustment should help millions of borrowers get one step closer to loan forgiveness, and some borrowers have already received the news that their loans were canceled through this program.

For more information on how this program will impact you, visit our page on IDR account adjustment.

Even if you weren’t in an IDR plan before, it may be a good idea to sign up for one now, as your account may have been credited with more time toward IDR loan forgiveness through the account adjustment. For information on signing up for an IDR plan, visit our page on signing up for and switching repayment plans.

When Will My Loans Be Canceled or Forgiven Through IDR?

It will depend on which plan you are enrolled in and what loans you have. Depending on your income and how much you owe on your loans, you may be able to pay off your debt sooner than IDR loan forgiveness. Generally, there are four IDR plans: SAVE (replacing the REPAYE plan), PAYE, IBR, and ICR.

When will my loans be canceled under the SAVE plan?

If you continue to make payments under SAVE, any remaining balance on your loans will be canceled after:

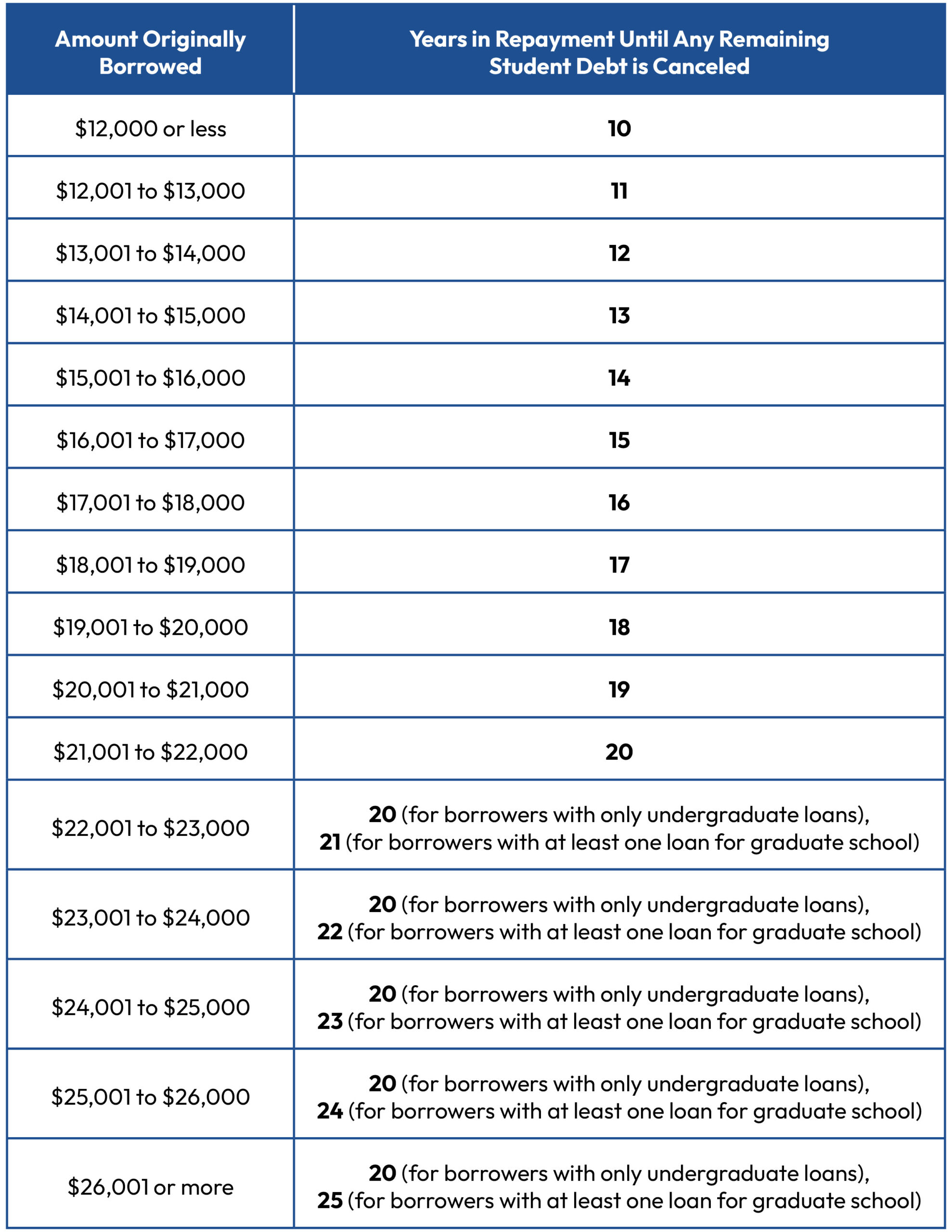

- 10 years of payments if you borrowed $12,000 or less in principal on your loans,

- Less than 20 years of payments if you borrowed less than $21,000 and only borrowed loans for undergraduate education,

- 20 years of payments if all of the loans you’re repaying in the plan were for undergraduate education and you borrowed more than $21,000,

- Less than 25 years of payments if you borrowed any loans for graduate school and you borrowed less than $26,000 in principal,

- 25 years of payments if any of the loans you’re repaying in the plan were for graduate school and you borrowed more than $26,000 in principal.

See the chart below and our blog post on this issue for more information on when you may be eligible for cancellation under the SAVE plan.

When will my loans be canceled under a PAYE plan?

If you continue to make payments under PAYE, any remaining balance on your loans will be canceled after 20 years of payments.

When will my loans be canceled under an IBR plan?

If you continue to make payments under IBR, any remaining balance on your loans will be canceled after:

- 20 years of payments if you were a new student loan borrower on or after July 1, 2014, or

- 25 years if you were a new student loan borrower on or after July 1, 2014.

When will my loans be canceled under an ICR plan?

If you continue to make payments under PAYE, any remaining balance on your loans will be canceled after 25 years of payments.

Do I Need to Apply for IDR Loan Forgiveness?

No. IDR loan forgiveness is automatically granted after you make your last qualifying IDR payment.

You do need to make sure you are on an IDR plan or the standard repayment plan to keep earning credit toward IDR loan forgiveness after the one-time account adjustment. In many cases, your monthly repayment amount will be less in an IDR plan. You may also need to consolidate your loans first to become eligible for an IDR plan. For more information, see our pages on IDR payment plans and consolidating your loans.

If you think you should have already been eligible for IDR loan forgiveness but didn’t receive it, file a complaint with the FSA Ombudsman. You may get loan forgiveness after the Department of Education completes its one-time account adjustment, but you should check with the Ombudsman if you haven’t received any information yet.

Will I Have to Pay Taxes on Any Loan Balance That is Forgiven Under the IDR Plan?

Through the end of 2025, there are no tax consequences for having your student loans forgiven through an IDR plan, but unless the law changes, there may be tax consequences for any amount of your student loan debt that is forgiven through IDR beginning in 2026. You should speak with a tax professional for more information about any tax implications.