In order to understand your student loan situation and make decisions about how to manage your student loans, you need to know a few basic things:

- What type of student loans do you have?

- What is the status of your loans?

- Who holds the loans?

- Who is your loan servicer?

- What are your student loan goals?

Finding Your Student Loan Information

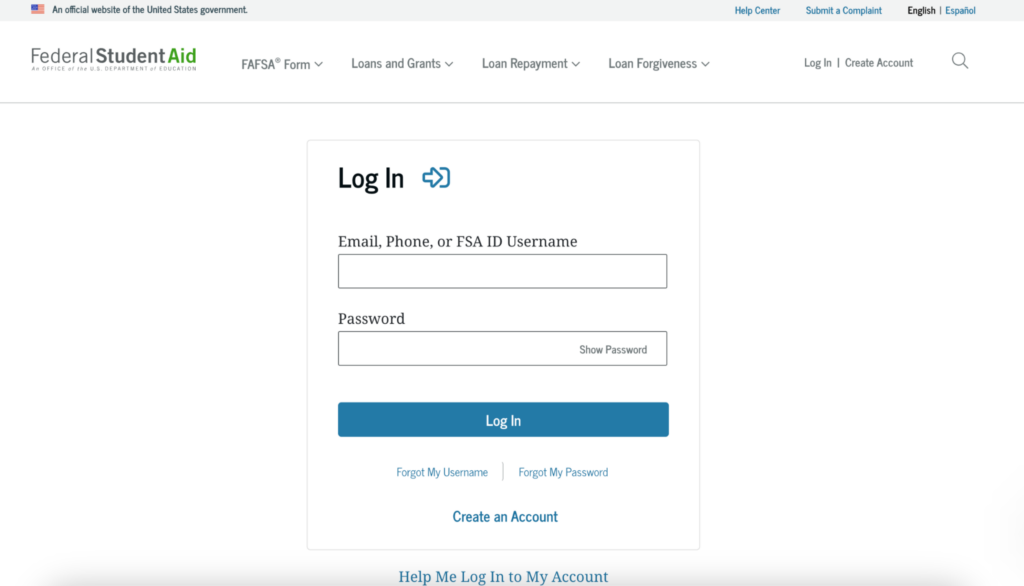

Most of the information you need to understand your federal student loans can be found online by logging in to StudentAid.gov. See our page on Finding Your Student Loan Information for more help.

What type of student loans do you have?

The first thing you need to know to understand your student loan situation is what type of loans you have. To do so, you must answer two important questions:

- Do you have federal loans or private loans?

- What type of federal loans do you have?

It is important to know exactly what type of loans you have because you have different options for managing your student loan debt depending on the loan type. See our page on Finding Your Student Loan Information for more help.

What is the status of your loans?

Depending on your situation, your loans may be in repayment, in a grace period (if you recently left school), in deferment, in forbearance, delinquent, or in default.

Who holds the loans?

A loan holder is the owner of your student loans. Most federal student loans are owned and held by the federal government through the Department of Education. There are some older federal student loans that are owned and held by a private company or state agency. It is important to know if your federal loans are held by the Department of Education or some other entity because your options for student loan relief may be different if the Department of Education does not own or hold your loans. For private student loans, the loan holder is usually a bank or lending company that owns your loans.

It is possible that the loan holder may have changed since you first took out the loan. Visit our page on loan holders for more information on finding who owns your loans.

Who is your loan servicer?

A loan servicer is the company that the loan holder hires to manage your student loans. The loan servicer is usually a different company or agency than your loan holder. The federal government uses different companies to service federal student loans it holds. Some of these companies also service private student loans and federal loans that are not held by the Department of Education. See our page on who is your loan servicer for more information on how you can find your servicer information.

Changes coming to federal student loan servicers

The Department of Education recently announced that it will be making changes to who it uses to service federal student loans. Over the next several months, you may get notice from the Department of Education that your loan servicer will change. For more information, see our loan servicing page.

What are your goals for your student loans?

You have different options for dealing with your student loans depending on what your goals are. These are some questions to consider:

- Do you want to pay off your loans as soon as possible?

- Are you looking for a more affordable repayment plan?

- Do you want to see if your loans can be canceled or forgiven?

- Do you need to stop collections (like wage garnishment or seized tax refunds) or get out of default?

For more help deciding how to approach your student loan debt based, visit our page on student loan goals.