There are different ways to find your student loan information depending on if you have federal or private student loans. It may be hard to tell at first glance if you have a private or a federal loan because many private student loan lenders also manage and service federal student loans. You may also have both federal and private student loans.

Find your federal student loans on studentaid.gov

The first thing you should do is log in to your account on studentaid.gov. Your loan details will be listed on your Dashboard. Any loans listed on your studentaid.gov account are federal student loans. It is important to know exactly what types of federal student loans you have, as some loan benefits are only eligible for certain types of federal loans. On the Dashboard, you can also see the status of your loans (in repayment, grace period, forbearance, deferment, delinquent, or in default), what repayment plan you are in if you’re in repayment, and who your loan servicer is.

Setting up an account on studentaid.gov

For more help on how to create an account and log in to studentaid.gov, see this help video.

See your loan details

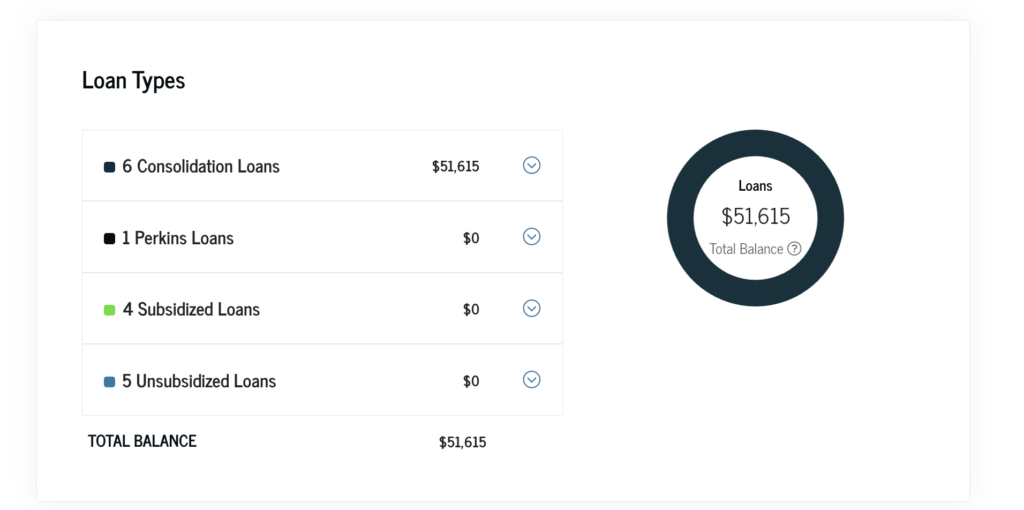

On the Dashboard, click on “View Details” to see an overview of your loans. Scroll down to the “Loan Breakdown” section, where you’ll see a list of your loans, including loans you paid off or consolidated into a new loan.

Watch the short video below to learn more about how to find your student loan information on studentaid.gov.

Find your private student loan information

Private student loans are not listed on studentaid.gov because they are not issued or managed by the federal government. If you know who your private loan servicer is, you can log in to your online account with the servicer, or call your servicer to get your loan information.

Unlike federal loans, there isn’t a central place that stores all of your private student loan information. However, your private student loans may be listed on your credit reports. Because federal student loans are usually listed on your credit reports too, it may be hard to tell if the loan listed is a federal loan or a private loan. If the loan is labeled as “Department of Education,”“DEPT of ED,” or “DEPTED,” it is likely that it is a federal loan, but not all federal loans are listed this way on a credit report.

Check your credit report for free

You can get a free copy of your credit report once a week from each of the big three credit reporting agencies at annualcreditreport.com until the end of 2023. After that, you can get a free copy once a year in most cases.

Compare the loans listed on your studentaid.gov account with your credit report. Any loans that are listed on your studentaid.gov account are federal student loans. If any loans on your credit reports are not listed on your studentaid.gov account, they are probably private student loans.

Another way to tell if you have a private loan and to find your loan information is to look at any loan statements, collection letters, emails, or loan agreements you have. Common private student loan lenders include SoFi, Earnest, LendKey, Discover, and Citizens, but there are many other lenders that offer private student loans. Sallie Mae, Navient, and Mohela also offer private student loans, which can be confusing for borrowers who have federal student loans that are serviced by these companies.

If you find out that you do have a private student loan, you can get more information about your loan from your loan servicer. If you don’t know who your loan servicer is, the company’s name may be listed on your credit report or on emails or letters that you receive about the loan. You can also ask for a disclosure statement from that company that should include important information about your private student loan.

If you need more help determining your loan situation, visit our Find Help page.