Usually you have to recertify (update) your information each year, on time, with your loan servicer or the Department of Education to stay on your IDR plan. You can also recertify sooner if your income decreases to see if you are eligible for a lower monthly payment.

Because of the COVID-19 Payment Pause, the requirement to recertify your IDR plan each year was also temporarily suspended for all of the loans that were paused. The payment pause ended on September 1, 2023. If your loans were covered by the payment pause, then you will not need to recertify your IDR plan before September 2024 at the earliest. Your servicer can tell you your recertification deadline. You can recertify at any time though, and it may be a good idea to recertify sooner if your income is lower than it was before the payment pause went into effect.

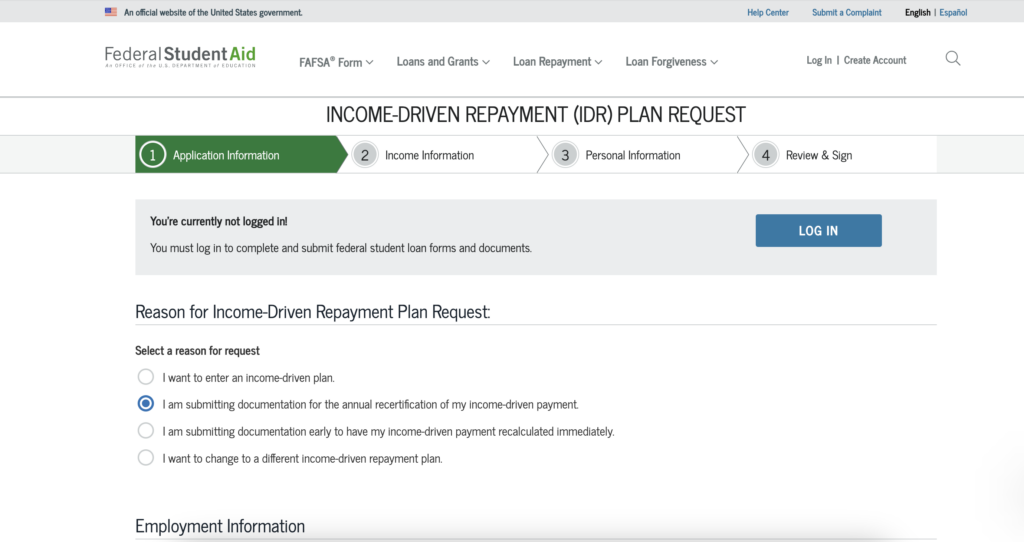

To recertify your IDR plan, you have to submit information about your income and family size each year before your annual recertification date. Most borrowers can recertify online. When you recertify online, you can choose to share information directly from the IRS to the Department of Education about income. This can save you time by not requiring you to provide separate proof of your income. The online application form will also ask you for permission to automatically collect and recertify your income and family size information based on the income you report to the IRS on your taxes each year. You can alternatively fill out a paper form, and attach proof of income, to recertify.

Your loan servicer should contact you about a month before your recertification deadline to remind you to recertify, but it’s a good idea to set reminders for yourself so you don’t miss the deadline. Even if you give the Department permission to automatically recalculate your repayment amount using the income you reported to the IRS in last year’s taxes, you should still watch your account closely to make sure your income was correctly certified each year.

Missing the deadline to recertify for IDR plans is very common, but can lead to real headaches. If you miss the recertification deadline, your monthly bill may suddenly increase to an amount that isn’t affordable. In some plans, missing the deadline may also lead to being removed from the plan entirely or having unpaid interest added onto your balance (called capitalization). If you do miss your recertification deadline, don’t panic but act quickly: contact your servicer, submit your income documentation as soon as possible so you can get your monthly payments recalculated, and request a temporary forbearance if you can’t afford your current bills until your monthly payments are recalculated.

My IDR payment seems too high. I think my loan servicer made a mistake. What can I do?

If you disagree with how your loan servicer calculated your IDR payment after you recertified your IDR plan, call your servicer. It’s possible a mistake was made. You may also be able to switch plans to get a lower monthly payment amount if there wasn’t a mistake. If you still think the payment amount is wrong, you can file a complaint with the Federal Student Aid Ombudsman.

Recertify Your IDR Plan Online

You can recertify your IDR plan in minutes using the online recertification form. Answer a few questions, click submit, and wait to hear back from your loan servicer. It’s that simple!