Today, the Biden-Harris Administration announced that some borrowers will soon begin receiving debt cancellation after as few as 10 years in repayment, instead of the 20 to 25 years of payments previously required for most borrowers.

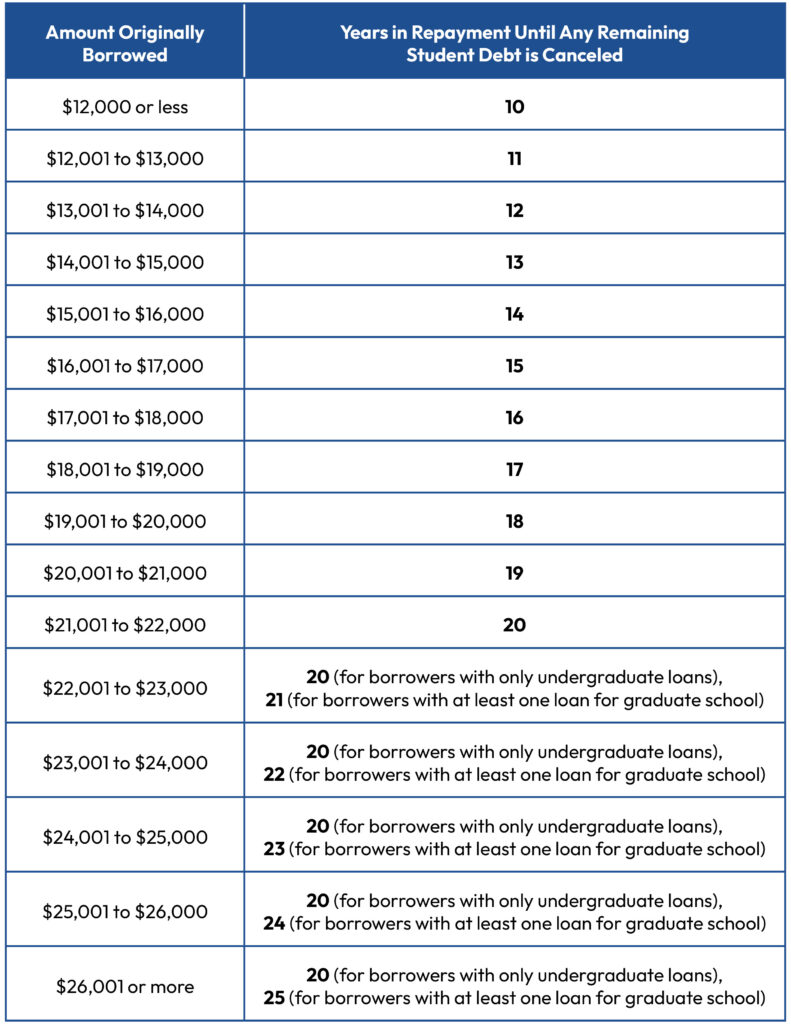

Starting in February, borrowers who are enrolled in the Saving on a Valuable Education (SAVE) Plan and who originally took out $12,000 or less in federal student loans will have any remaining balance on their loans canceled after 10 years of qualifying time in repayment. People who borrowed more than $12,000 may also benefit: For every additional $1,000 borrowed, the borrower will have one additional year in repayment added, up to a maximum of 20 years (for borrowers repaying only undergraduate loans) or 25 years (for borrowers repaying at least one graduate loan).

The table below shows when a borrower will be eligible to have their debt canceled based on how much they originally borrowed in federal student loans.

Borrowers who have made payments after they were eligible for forgiveness should get a refund of those amounts. The Department of Education has an FAQ with more details about how this program will work here.

What do borrowers need to do to benefit?

Borrowers who are already enrolled in SAVE do not have to do anything other than remain in the SAVE program and continue making any required monthly payments. Once borrowers in SAVE reach the required amount of time in repayment, the Department will cancel their remaining balance. Borrowers should get an email and/or letter when this happens.

Borrowers who are not enrolled in SAVE should enroll if they want to benefit from this new timeline to loan cancellation. Below is how borrowers with different loan types can enroll in SAVE:

- Borrowers with Direct Loans that they took out for their own education (as opposed to Parent PLUS loans that they took out for their child’s education) can enroll in SAVE directly. Enroll online at studentaid.gov/idr or by calling your student loan servicer and asking for help enrolling in SAVE. Applying online should take about 10 minutes or less.

- Borrowers with older federal student loan types, including Federal Family Education Program Loans (FFEL or FFELP) and Perkins Loans, can also enroll in SAVE by consolidating their loans into a Direct Consolidation Loan and requesting to repay it using SAVE. The whole process should take about 30 minutes or less. Find out whether you have these older loan types by using the Department of Education’s Loan Simulator, checking your loan details on studentaid.gov, or calling the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

If possible, consolidate by the end of April 2024 to be included in the one-time account adjustment (discussed below) and get more of your time in repayment counted toward loan forgiveness.

- Borrowers with loans in default can take advantage of the Fresh Start program to get out of default and enroll in SAVE. Find out how to request a Fresh Start here. Borrowers who have defaulted FFEL or Perkins loans must consolidate to enroll in SAVE.

Unfortunately, Parent PLUS borrowers are generally not eligible for SAVE, although they may be able to access the plan for a limited time through a more complicated workaround (see here for more).

What time counts toward the 10 years?

This used to be a very complicated question, but thanks to the Administration’s one-time payment count adjustment, any past time in repayment between July 1, 1994 and now will be counted as qualifying time toward loan forgiveness in the SAVE plan. This includes:

- all time in repayment (not in a forbearance, deferment, grace period, or default), no matter which payment plan they were on;

- all time between March 2020 and September 2023 (when payments were paused due to the pandemic), whether or not the borrower made payments.

Additionally, some prior time in deferments and forbearances will count, including:

- all time spent in economic hardship deferments;

- all time spent in any deferment (except in-school deferment) prior to 2013;

- 12 or more months of consecutive time in forbearance;

- 36 or more months of total time in forbearance

- borrowers can also submit a complaint to the Federal Loan Ombudsman to ask that shorter periods of forbearance be counted if their loan servicer told them they weren’t eligible for IDR.

For consolidated loans, any time in repayment before consolidation also counts.

After the one-time payment count adjustment is completed in roughly July 2024, borrowers will generally need to make payments in an IDR plan to continue accruing more time toward forgiveness.