To help fix massive past problems in the student loan system that prevented people from getting the credit they should have toward loan forgiveness, the Department of Education is currently working on giving borrowers retroactive credit toward loan forgiveness. The Department is calling this credit a “one-time payment count adjustment.” The goal of the payment count adjustment is to help borrowers who have been hurt by loan servicing failures get the credit they should for the time they have already spent in repayment. This will help millions of borrowers get closer to having their loan balances canceled–in fact, over 900,000 borrowers have already had their loans canceled through this fix so far.

Most borrowers will be eligible for this credit automatically and will not have to do anything to see their student loan accounts adjusted with this credit. But borrowers with certain types of student loans will have to apply to consolidate those loans by April 30, 2024 in order to be eligible for this additional credit toward debt relief.

Do I need to consolidate my loans to get additional credit toward debt relief?

If you have FFEL Loans, Perkins Loans, or Health Education Assistance Loans (HEAL) that are privately held, you need to apply to consolidate by April 30, 2024 to be eligible for additional credit for loan forgiveness on those loans.

If you have federal student loans that are owned and managed by the Department of Education (including any Direct Loans), you don’t need to do anything to benefit from this adjustment– your account will be updated automatically.

How do I know if I have FFEL Loans, Perkins Loans, or Health Education Assistance Loans (HEAL) that are privately held?

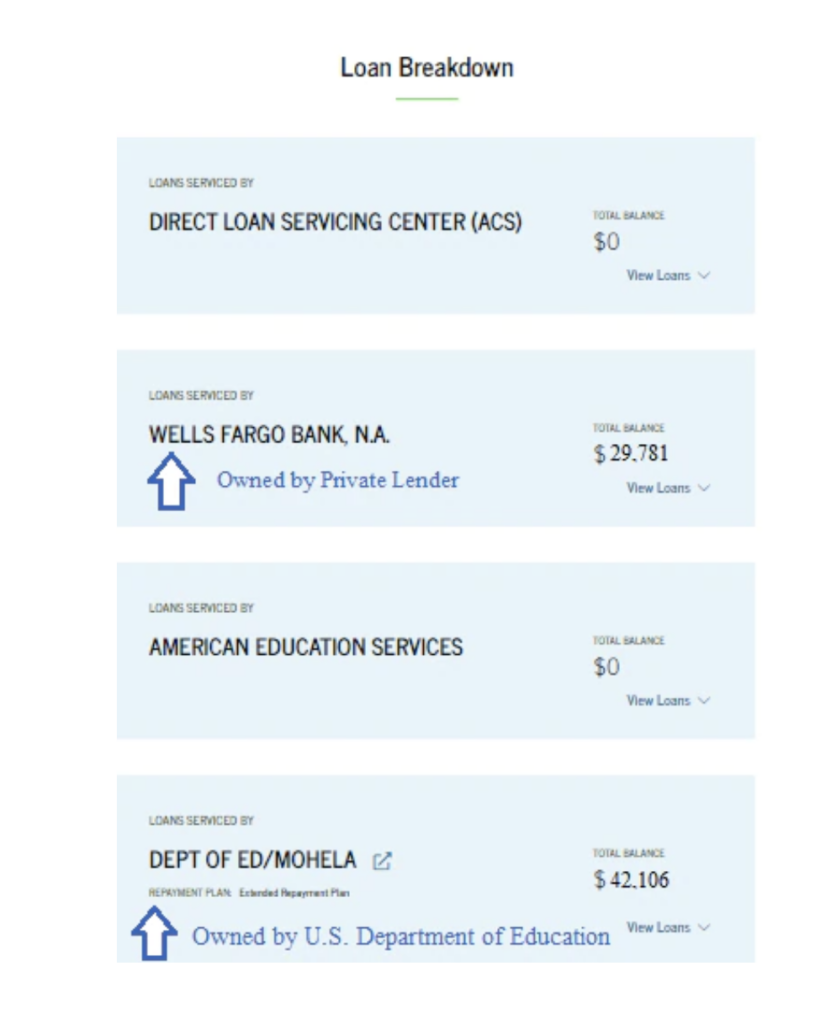

Log in to your account on studentaid.gov. On your Dashboard click on “View Details.” Scroll down to “Loan Breakdown.” You only need to worry about loans with a balance and can ignore loans that show a $0 balance.

If the name of the loan servicer starts with “Dept. of Ed” or “Default Management Collection System,” then that loan is held (owned) by the federal government and does not need to be consolidated. If the name of the loan servicer starts with either a company’s name or a school’s name, the loan is privately held and needs to be consolidated by April 30th in order to get credit toward debt relief.

What does this look like on studentaid.gov?

I have loans I need to consolidate – what do I do next?

To apply for a loan consolidation, go to www.studentaid.gov/loan-consolidation/. The application will walk you through the steps. You can also print a paper application. Borrowers with privately-held FFEL, Perkins, or HEAL loans should apply to consolidate as soon as possible—but no later than April 30, 2024—to get the full benefits of the adjustment. As part of the application, you can also apply for the SAVE plan or another payment plan option. The whole process typically takes less than 30 minutes.

After I consolidate, when will I see credit toward loan forgiveness on my account?

The Department of Education is working to review all borrowers’ loans for the payment count adjustment right now, but it will likely take a long time to finish the process. Some borrowers have already been told their loans are being forgiven through the payment count adjustment. The Department of Education plans to set up a system on studentaid.gov for borrowers to track how much credit they have toward IDR loan cancellation, but this feature is not available now. If you think you should be eligible for forgiveness now or after your loans are consolidated, contact the FSA Ombudsman for help.

If you are pursuing Public Service Loan Forgiveness (PSLF), you can track how many qualifying payments you have on your online account with MOHELA. Remember, you need to submit an Employment Certification Form (ECF) for each public service job you held while in repayment in order to get credit for PSLF. If you recently consolidated your loans to take advantage of the payment count adjustment, it may take a while for your account with MOHELA to be updated to reflect your qualifying payments. We wrote about this issue recently for PSLF borrowers.