Consolidation Deadline Extended to June 30, 2024

Today, the Department of Education announced that the consolidation deadline to take advantage of the payment count adjustment has been extended until June 30, 2024. Borrowers with older federal student loans that are not held by the Department need to apply to consolidate those loans into a Direct Consolidation Loan in order to get additional credit toward having their loans canceled through income-driven repayment (IDR) or Public Service Loan Forgiveness (PSLF) under the payment count adjustment. Borrowers with these loans who missed the previous April 30th deadline will now have one more opportunity to consolidate their loans into the Direct Loan Consolidation program to take advantage of the payment count adjustment.

Borrowers Will See Their Credit Toward Loan Forgiveness in September 2024

The Department also announced that the payment count adjustment should be complete in September 2024 and that borrowers should then be able to see a full and accurate account of their progress toward loan forgiveness through either income-driven repayment and PSLF.

The payment count adjustment has already helped almost 1 million borrowers achieve forgiveness of their student loans. Don’t miss out on this opportunity. If you have a loan that needs to be consolidated to get credit toward loan forgiveness, apply to consolidate today. Read below to see if you need to consolidate your loans by June 30th to get credit toward loan forgiveness.

More information on the payment count adjustment.

Do I need to consolidate my loans to get additional credit toward debt relief?

If you have privately-held FFEL Loans, Perkins Loans, or Health Education Assistance Loans (HEAL), then you need to apply to consolidate those loans by June 30, 2024, to be eligible for additional credit for loan forgiveness on those loans.

How do I know if I have FFEL Loans, Perkins Loans, or Health Education Assistance Loans (HEAL) that are privately held?

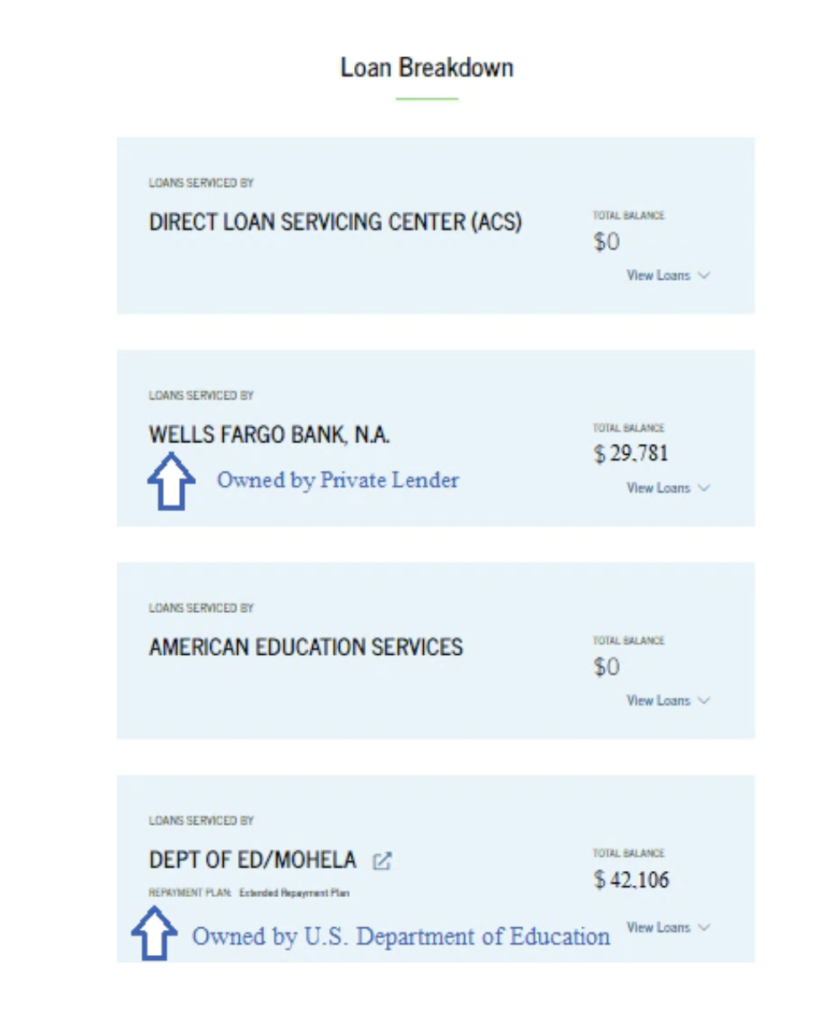

Log in to your account on studentaid.gov. On your Dashboard click on “View Details.” Scroll down to “Loan Breakdown.” You only need to worry about loans with a balance and can ignore loans that show a $0 balance.

If the name of the loan servicer starts with “Dept. of Ed” or “Default Management Collection System,” then that loan is held (owned) by the federal government and does not need to be consolidated. If the name of the loan servicer starts with either a company’s name or a school’s name, the loan is privately held and needs to be consolidated by June 30th in order to get credit toward debt relief.

See our page on loan holders for more information.

What does this look like on studentaid.gov?

See the example photo of what the Loan Breakdown looks like. In this example, the borrower has two loans with outstanding balances, one that is already owned (held) by the Department of Education and doesn’t need to be consolidated, and one that is owned (held) by a private lender that needs to be consolidated by June 30th to get credit toward debt relief.

I have loans I need to consolidate – what do I do next?

To apply for a loan consolidation, go to www.studentaid.gov/loan-consolidation/. The application will walk you through the steps. You can also print a paper application. Borrowers with privately-held FFEL, Perkins, or HEAL loans should apply to consolidate as soon as possible—but no later than June 30, 2024—to get the full benefits of the adjustment. As part of the application, you can also apply for the SAVE plan or another payment plan option. The whole process typically takes less than 30 minutes.

Note that you should only consolidate these loans into the federal Direct Loan program. Refinancing these loans with a private company will make them ineligible for the account adjustment and for IDR and PSLF.