Today, the U.S. Department of Education officially published new rules stripping away protections put in place by the Obama administration in what is often called the “borrower defense rule.” As a result, students who were harmed by school misconduct or closures will have a harder time getting relief from their federal student loans or holding schools accountable for illegal conduct. The 2016 borrower defense rule was designed to rein in predatory school conduct and to ensure that student borrowers have a fair shot at holding their schools accountable and getting relief they are entitled to by law.

The Department of Education predicts that these rollbacks will mean that student loan borrowers hurt by school closures, fraud, and misleading recruiting practices will receive $512.5 million less in student loan relief per year. This is unconscionable.

Student loan debt is at crisis levels, and the students suffering the most include those who went to schools that closed abruptly, used questionable recruiting practices to convince people to enroll, or both. This rule, if it goes into effect (we expect legal challenges), will encourage schools to double down on risky and illegal practices. And it will make it much less likely that student borrowers will get the loan relief they need and deserve.

The new, less student-friendly rules are scheduled to go into effect July 1, 2020. Most of the changes to student relief rights will only apply to new loans first disbursed on or after that date, and so most current borrowers will not be impacted. Information for current borrowers on getting loan relief based on school misconduct or closure is available on our website.

But some changes will kick in sooner and may hurt current student borrowers. For example, current borrowers attending a school that closes after July 1, 2020 will be stuck with their loans unless they apply for a closed school discharge. In contrast, many borrowers whose school closes between November 1, 2013 and June 30, 2020 will have their loans automatically cancelled.

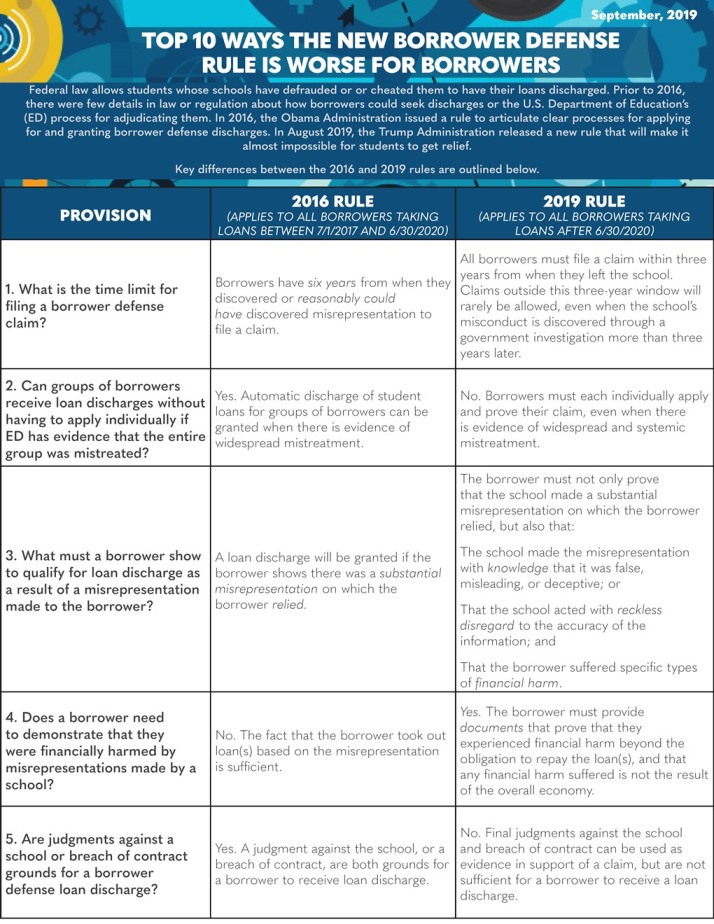

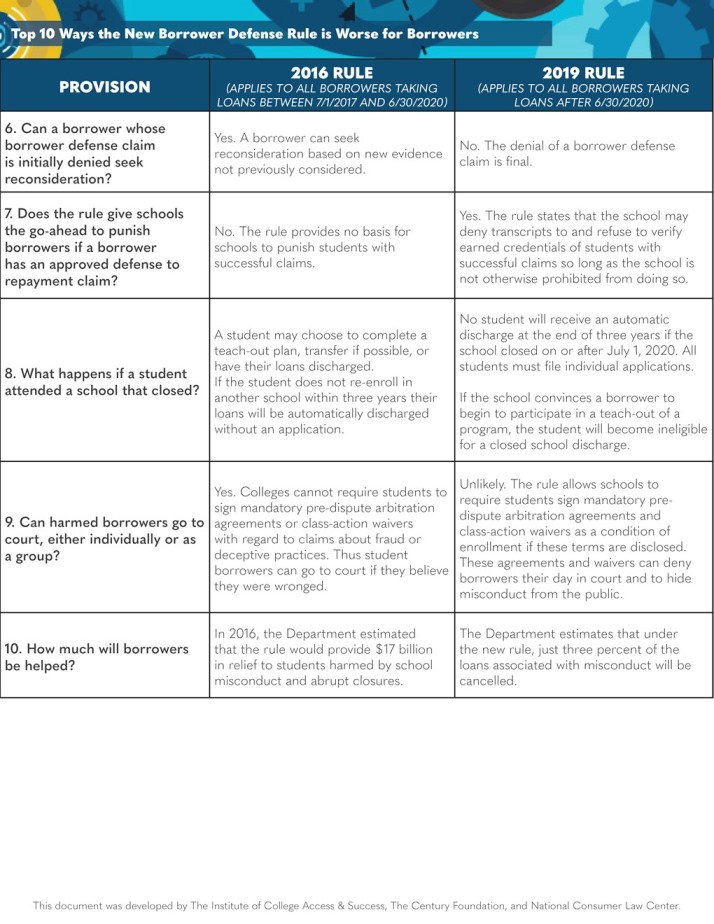

To make the important differences between the 2016 borrower defense rules and the new rules clear, we’ve worked with The Institute for College Access & Success (TICAS) and The Century Foundation to create the chart below, listing the top 10 ways the new borrower defense rule is worse for student loan borrowers.