By: Kendra Cobb*

Last month marked the 25th anniversary of the first income-driven repayment (IDR) plan: the Income-Contingent Repayment Plan (ICR). This means that student loan borrowers who entered ICR in 1994 should begin receiving loan forgiveness for completing 25 years of qualifying payments. Borrowers enrolled in ICR who have not yet completed 25 years of payments can achieve forgiveness sooner or immediately by switching to another IDR plan with a shorter repayment period—and they may also reduce their monthly payments by switching.

Loan Forgiveness Under Income-Driven Repayment (IDR) Plans

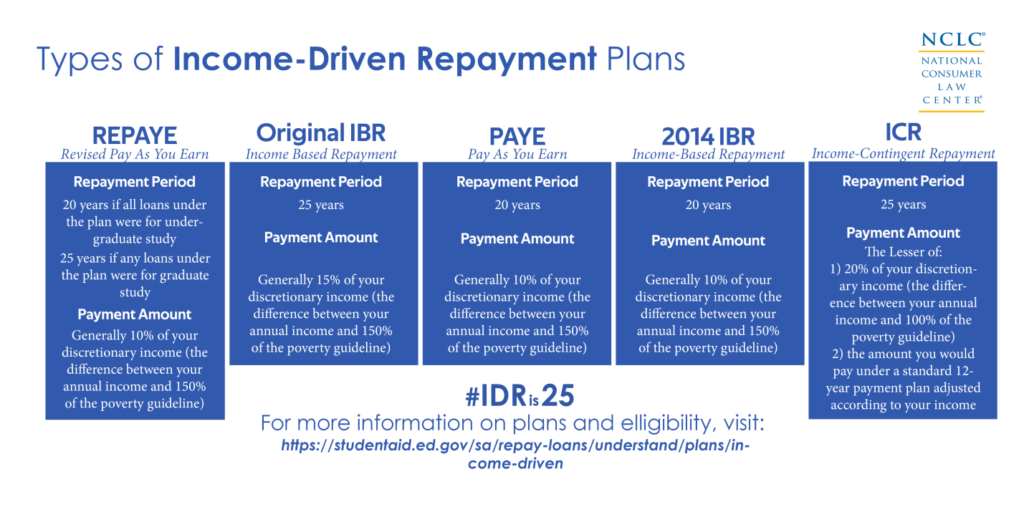

The Department of Education offers multiple IDR plans to Direct Loan borrowers: Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay-As-You-Earn (PAYE), and Revised Pay-As-You-Earn (REPAYE). Borrowers can choose an IDR plan that allows them to pay a percentage of their discretionary income toward their student loans. These plans can help many borrowers afford their loan payments, avoid the severe consequences of default, and ultimately, receive loan forgiveness. Each plan forgives any remaining balance of the borrower’s loans after a period of 20 or 25 years of making qualifying payments. The amount forgiven is taxable, which means the borrower may pay income taxes as if they earned the forgiven balance as income.

Borrowers in ICR Can Achieve Forgiveness Sooner by Switching Plans

While ICR requires a 25-year repayment period for borrowers to achieve loan forgiveness, several other IDR plans require a 20-year repayment period. When switching IDR plans, borrowers generally keep credit for the number of qualifying payments already made under another IDR plan. This means that some borrowers can have their loans forgiven immediately or sooner by switching to an IDR plan with a shorter repayment period.

In particular, borrowers in ICR can switch to REPAYE and achieve immediate forgiveness if the borrower: 1) entered ICR prior to July 1999; 2) has made at least 20 years of qualifying payments; and 3) does not have loans for graduate school.

Borrowers in ICR with fewer than 20 years of qualifying payments may still be able to achieve forgiveness sooner by switching to one of the other IDR plans. A few things to keep in mind:

- If the borrower has loans for graduate school, then REPAYE requires a 25-year repayment period.

- The PAYE and 2014 IBR repayment plans also forgive loan balances after 20 years, but, unlike REPAYE, these plans are only available to borrowers who took out their first federal student loans much later than 1999.

- Borrowers who consolidated a Parent PLUS loan into a Direct Consolidation Loan are not eligible to repay that loan under REPAYE, PAYE, or IBR, even though they are eligible to pay under ICR.

- Think carefully before consolidating: Borrowers who consolidate their loans reset their qualifying payment count and lose credit for the number of qualifying payments made prior to consolidating.

Borrowers in ICR Can Reduce Payments by Switching Plans

Even for ICR borrowers who have not made twenty years of qualifying payments, there are still benefits to switching IDR plans. Not only can switching help borrowers achieve forgiveness sooner, but many borrowers would also see significant decreases in their monthly payments.

The ICR plan uses a different formula and a different definition of discretionary income than other IDR plans and as a result the payments are generally more expensive. ICR borrowers currently repay their student loans with the lesser of (A) 20% of their income in excess of 100% of the federal poverty guideline or (B) an amount based on payments under a 12 year plan. In contrast, borrowers in other IDR plans only repay 10% or 15% of their income in excess of 150% of the federal poverty guideline. These calculations can make a huge difference for borrowers. For example, a single borrower with two kids, an adjusted gross income of $50,000, and a $35,000 Direct Loan balance at 6% interest would have their monthly payments cut from $315 to $150 by switching from ICR to REPAYE.

Bottom line: ICR borrowers can switch IDR plans to achieve loan forgiveness faster or reduce their monthly payments.

Have you achieved loan forgiveness by switching IDR plans? Share your story!

*Kendra Cobb is an intern at the National Consumer Law Center and a rising third-year law student at Howard University School of Law who is passionate about financial services and economic empowerment.