This post originally appeared on https://protectborrowers.org/qualifying-payments/

This year, we’ve seen lawmakers in states across the country demand accountability from the private-sector student loan companies that handle loans for more than 44 million Americans. These breakdowns include lost paperwork and shoddy record-keeping when loans are transferred between companies—a process that has affected more than 10 million student loan borrowers over the past decade.

In California, we are working with lawmakers and advocates to advance legislation that includes strong new standards to protect borrowers when loans are transferred between companies, ensuring breakdowns no longer damage borrowers’ credit, increase interest charges, and jeopardize progress toward and eligibility for a range of loan forgiveness and debt cancellation options.

The Trump Administration has raised the stakes for tens of millions of borrowers, pulling down planned consumer protections while advancing a sweeping new proposal that will cause more than 37 million borrowers’ loans to change companies in the coming years. The following guest post from Persis Yu, Director of the Student Loan Borrower Assistance Project at the National Consumer Law Center, illustrates how loan transfers can lead to serious problems for borrowers pursuing loan forgiveness under an income-driven repayment plan or Public Service Loan Forgiveness—just one example of the problems hurting consumers across the student loan system every day.

———————————————————————————————————-

By now you’ve probably heard about the problems with the Public Service Loan Forgiveness program. I addressed this issue in an October 2018 blog post, 96 Out of 28,000 Borrowers Approved for Public Service Loan Forgiveness … What Does This Mean for Everyone Else? In April, the New York Times highlighted one of the problems keeping borrowers from accessing loan forgiveness: errors in the count of their qualifying payments.

One might think, if it’s just counting, how hard could this be?

This is where the complicated program features come in. To be eligible for loan forgiveness under PSLF, borrowers need to make 120 qualifying payments. This means that the payment needs to be the right amount, made at the right time, and in the right type of repayment plan. (PSLF also requires that these qualifying payments need be made simultaneously while working the right number of hours in the right kind of job.)

So the month in which you made the payment a couple weeks late does not count. Or if you made payments when your servicer put you in an administrative forbearance to renew your income driven repayment (IDR) plan, those don’t count either. Or if the customer service representative suggested that you switch to the extended repayment plan for a year because you could make a lower payment, all those payments don’t qualify.

So how do you know which payments qualify? Well if you kept meticulous records for over a decade, you might be able to piece that information together. Maybe. But what if you mailed payments? How would you know when the servicer received and applied the payment? Your servicer may have placed your account in an administrative forbearance for a short period of time to resolve a paperwork issue and you might not have documentation of it.

Importantly, borrowers cannot rely on their servicers to get this count right. For example, we’ve heard from a number of borrowers who have challenged FedLoan Servicing, which is one of the Direct Loan servicers and is the specialty servicer for PSLF, on its PSLF count and gotten the count corrected.

In order to verify the number of qualifying payments and to ensure that servicers are counting payments properly, borrowers need to have access to a full and complete payment history. Sadly though, borrowers do not currently have easy access to this information. Borrowers are able to get basic level information about their federal loans from the National Student Loan Data System, but it does not provide payment level data.

The student loan servicer that is servicing a particular loan should have payment records, but the extent to which they make this information available varies by servicer. Unlike with mortgages where servicers are required to provide you with information within 30 days of a qualifying written request, there are no federal standards requiring a student loan servicer to give the borrower a payment history.

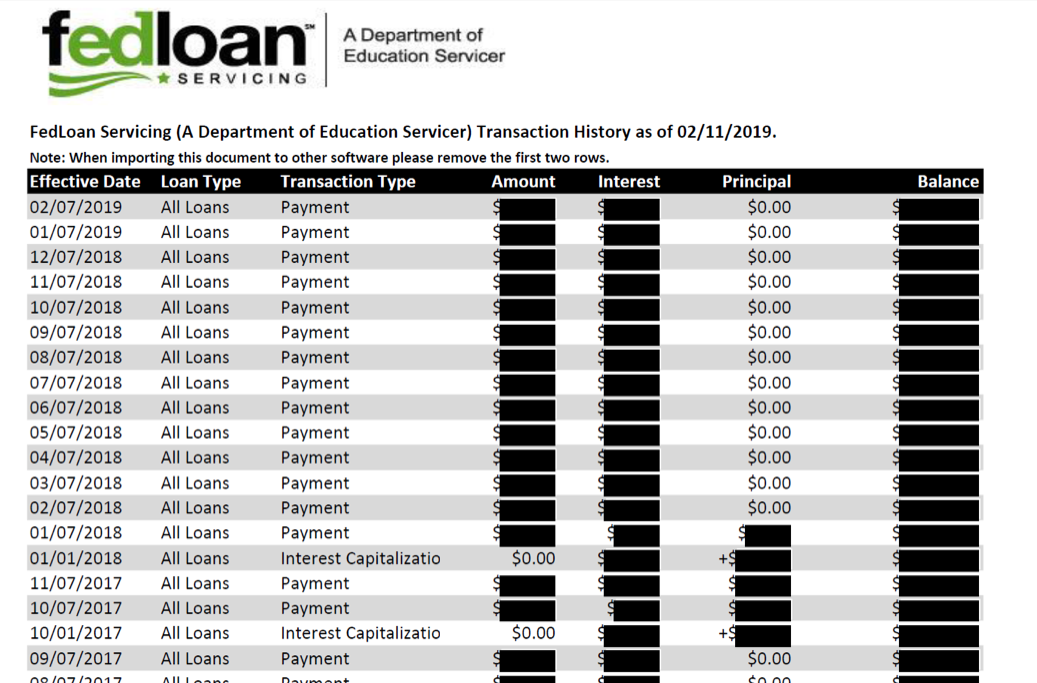

FedLoan’s website gives the borrower the option to download a payment history, but the spreadsheet it provides is far from complete.

As you can see, while it does have the payment amount and date, critically it doesn’t identify the borrower’s payment plan, which is necessary to know in order to determine whether the payment is a qualifying payment.

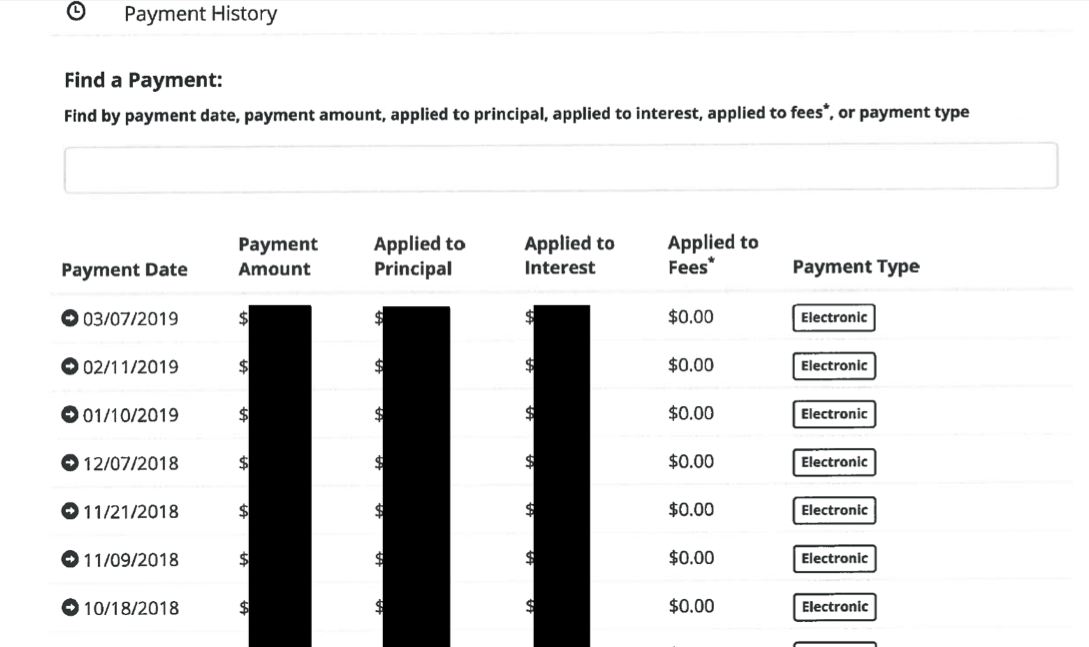

Here is an image of a payment history from Nelnet, one of the other Direct Loan servicers.

Although you cannot tell from the FedLoan payment history, that borrower is making payments in an IDR plan. The borrower with Nelnet, however, is in a deferment while making these payments. Neither of these payment histories provides that level of detail, making it impossible to tell from these records which borrower is making qualifying payments or how many.

Notably, a payment history received from Direct Loan servicer, MOHELA, shows not only the dates and amounts of the borrower’s payments, but also the borrower’s payment plan (not shown).

Critically, however, none of these payment histories provides any information prior to the loan being transferred to its current servicer. A lot of the counting problems stem from payments made prior to a transfer. According to the New York Times, FedLoan is telling borrowers seeking PSLF that it will take more than a year to get accurate histories of their payments that occurred prior to the transfer to FedLoan.

Until 2009, all Direct Loans were serviced by a single Direct Loan servicer, ACS (Xerox). In 2009, as it was moving to a system under which nearly all student loans were originated directly by the federal government through the Direct Loan Program, the Department of Education entered into new servicing contracts with four companies, Great Lakes Educational Loan Services, Nelnet, FedLoan Servicing (PHEAA), and Sallie Mae (now Navient). Loans were transferred from ACS to the new servicers between the years 2009 and 2013. The Department also contracts with a number of non-profit student loan servicers, including Cornerstone, Granite State, HESC/EdFinancial, MOHELA, and OSLA.

For almost all borrowers who are now seeking to have their loans cancelled through PSLF, servicing of their loans started with ACS and was then transferred to one of the new servicers between 2009 and 2013. This means that the problem of obtaining a complete payment history when servicing was transferred from one servicer to another is impacting nearly everyone applying for PSLF.

PSLF is not the only forgiveness program that requires counting months. For borrowers seeking forgiveness under an income driven repayment plan, these problems are just going to be magnified. Instead of keeping track of 120 payments, these borrowers (and their servicers) will need to keep track of 240 or 300 payments (20 or 25 years depending on the plan). And any Direct Loan borrower who will be expecting forgiveness in the next decade will have transferred servicers.

Critically, IDR forgiveness is supposed to happen automatically. If servicers are miscounting IDR payments, borrowers will be overpaying on their loans. Borrowers need assurance that their loan payments are being counted properly. Without access to an adequate payment history, keeping track of these payments and holding servicers accountable will be nearly impossible.

Have you tried to get your payment history? What was your experience? Share your story.