After the Supreme Court struck down the student debt cancellation plan, President Biden announced he would pursue an alternative pathway to provide debt relief to borrowers. The new approach involves using authority under the Higher Education Act, the federal law that governs the federal student loan programs, to provide debt relief to borrowers.

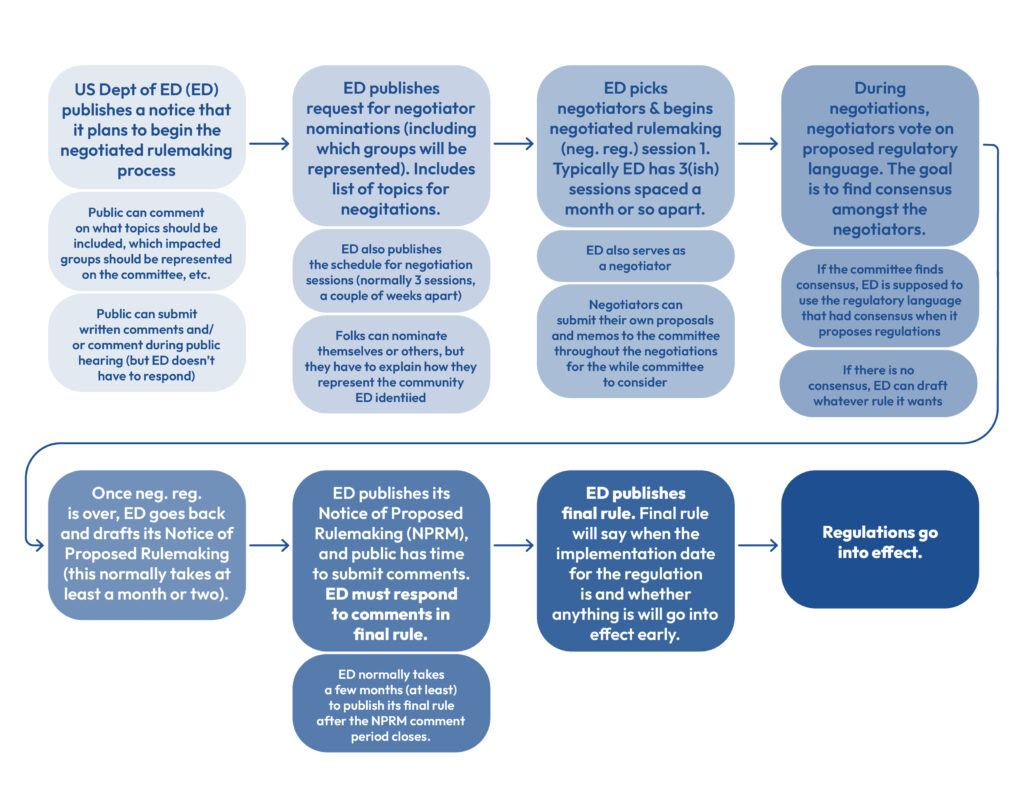

President Biden stated that this approach will take longer than his prior plan, which used a national emergency authority because the Department of Education will go through a longer legal process to develop the debt relief plan rules while seeking public input along the way. This process is called “negotiated rulemaking,” and it typically takes several months and often a year or more. The new debt relief plan that will be developed through this process could be similar to the prior plan or could be quite different. Borrowers can and should share what they think should be included in a debt relief plan this time around.

The Department of Education began the negotiated rulemaking process by inviting the public to submit written comments on debt relief or to speak in a virtual hearing. Anyone who is interested in the topic of debt relief and what the government should do about debt relief–including student loan borrowers–should consider submitting a comment or requesting to speak. You can submit a comment sharing your student loan story, why debt relief is important, or thoughts on what you think the government should do about debt relief online here by July 20, 2023. If you want to speak at the virtual public hearing on July 18, 2023, you should email negreghearing@ed.gov no later than noon, Eastern time, on July 17. The message should include your name, the topics you plan to address, and what times you are available to speak. Speakers selected will get 4 minutes to speak.

This public comment period is only the first step in the negotiated rulemaking process. Next, the Department will seek nominations for people to serve on a rulemaking committee and will select committee members. The Department will then present proposals to the committee to discuss and vote on. After the committee meetings, the Department will publish a proposed rule that the public can read and comment on. Finally, the Department will publish a final debt relief rule.

The chart below summarizes each phase of the negotiated rulemaking process.